LA LA LA LA LA LA LA LA -- Hat Tip: Market Ticker

That's the sound of someone with their fingers in their ears making noise so they don't have to listen to the person talking in front of them.

The list includes:

- Congress - warned explicitly in 1991 that repeal of Glass-Steagall was a bad idea and would lead to exactly what we're seeing now. LALALALALA.

- Congress (again) - warned repeatedly by the SEC in 2000 that removing caps on leverage (Requested by none other than Henry Paulson!) was demonstrably unsound (by the SEC of the time) - LALALALALALA.

- The SEC - warned about Madroff by Harry Markopolos - in writing - that Madroff was the world's largest Ponzi Scheme. LALALALALALALA.

- Alan Greenpan's fantasies were ignored by Congress and still are. But he did tell people what he was going to do and was up to in trying to thwart a mathematical long-wave cycle (Kondratieff Winter) and also stated that if he failed, what would occur would make The Depression look like "A Sunday-school picnic." LALALALALALALALA.

- The FBI and Congress (again) - there were petitions sent to Congress on behalf of thousands of property appraisers as far back as 2001 noting the pressure to falsify numbers. LALALALALALALA.

- Treasury and The Federal Reserve - the debt-to-GDP numbers are right in their face (hell, they report most of the base data!) but they think they can keep taking on debt to "solve" a solvency problem. LALALALALALALALA.

- US Consumers - There are only two ways to fix their balance sheets - sell the assets on which the debt is carried and pay it off or spend less than you earn. There is no third choice. LALALALALALALALA.

- Congress (again) - Bernanke and Paulson ("Subprime is contained", "We are not and will not go into recession", "The economy is fundamentally sound", etc etc etc.) Accountability for what are now known to be clear lies? LALALALALALALALA.

- Regulators in the R/E industry of all stripes - LandAmerica, a big title insurance company, has filed for bankruptcy. Why? Because instead of actually performing title searches title companies have been outsourcing the work to foreigners in places like India, where the so-called "search" has turned into nothing more than a quick dig through electronic records. Of course when there are real claims on the title the company is then on the hook and can't pay; instant boom! Where is the investigation of this obvious misrepresentation of what the purchaser of that policy bought? LALALALALALALALALALA.

- Obama still seems to think he can "soften the blow" by spending a trillion more (that we don't have.) He obviously hasn't bothered paying attention to the debt-to-GDP numbers, or to what happened in the 1930s as GDP fell away. This plan, if implemented, will give it to us in both holes as GDP will fall at the precise same time that debt increases. LALALALALALALALALA.

- Californicated is running a monster deficit and threatening to implode. Republicans are refusing to raise taxes while Democrats are refusing to cut spending. Neither party pays any attention to the fact that the state has been spending money that doesn't really exist (as a consequence of the housing bubble) on illegal immigrants from various social programs to schooling to jailing illegals instead of shipping them all home. As with the rest of the states, they spent all of the money during the flush years, and are now in serious trouble. LA LA LA LA LA LA.

- The Fed, Treasury and Congress all have known for years about the fact that banks were making bad loans that had no chance of being paid. The warnings were copious and unending. LALALALALALALALALA.

- Congress (again) still refuses to force financial institutions to state their actual, real, total exposure to bad debt, bring everything back onto balance sheets and stop marking to fantasy. Yes, that would mean we'd all get to see the bankruptcies in front of us. Its easier to stick your head in the sand. LALALALALALALALALA.

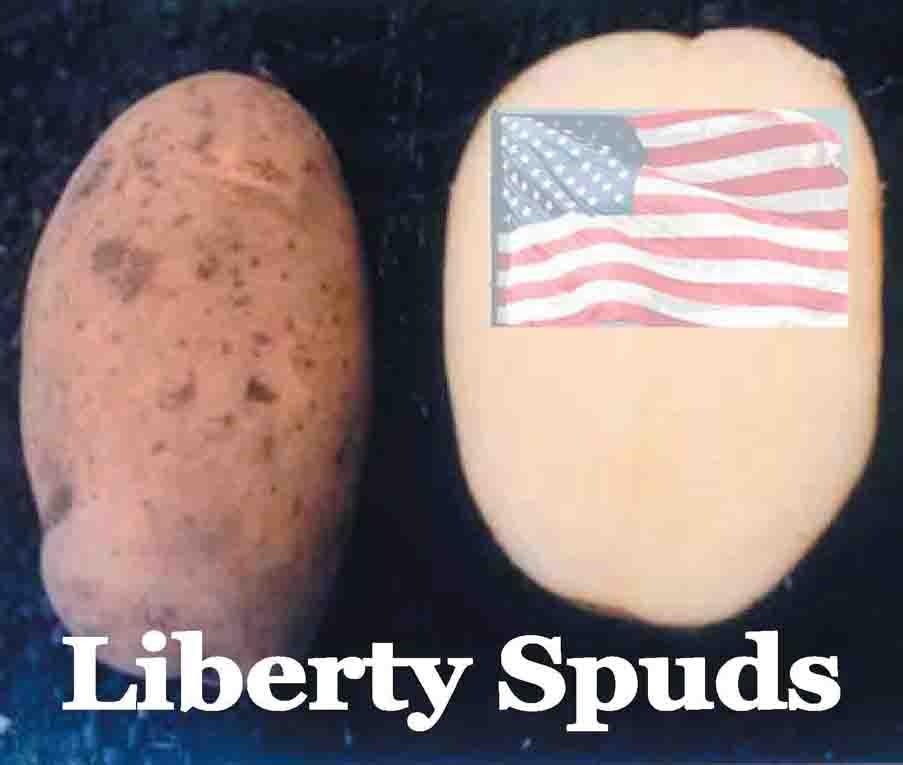

There's lots more but I think you get the point. If you still are having trouble figuring it out, here 'ya go - a picture is worth 1000 words.

No comments:

Post a Comment